By : Alvaro Hukubun )*

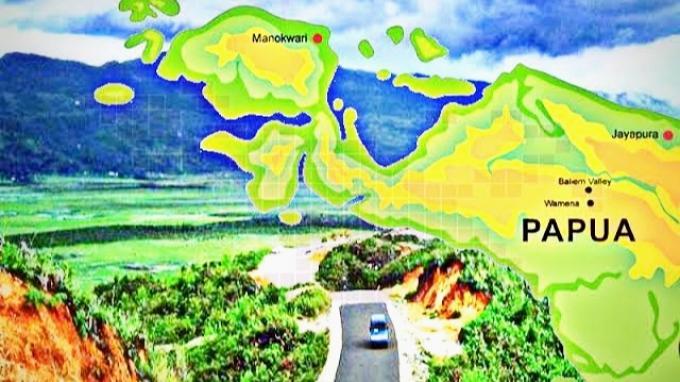

The development of the New Autonomous Region (DOB) of Papua is of course proof that progress in the Papua region continues to progress, even so progress in Cendrawasih must also be supported by fees, where these fees are very useful for increasing local revenue (PAD).

PAD itself has the aim of giving authority to regional governments to provide funds in accordance with the implementation of regional autonomy in accordance with regional potential as a manifestation of decentralization.

The Ministry of Home Affairs (Kemendagri) has held a coordination meeting to discuss the legal basis for collecting taxes and fees on new autonomous regions. The meeting was held with ministries, related institutions, and governors throughout Papua, at the Mercure Convention Center Ancol, Jakarta on 18 July 2023.

Agus Fatoni as the Director General of Regional Financial Development at the Ministry of Home Affairs said that the meeting was held according to directions from the Minister of Home Affairs (Mendagri), namely M Tito Karnavian. During the meeting, a number of officials also attended the event, including the Ministry of Home Affairs, the Ministry of Law and Human Rights to the Republic of Indonesia’s Attorney General’s Office.

Meanwhile, the regional government also attended a number of parties representing the 4 new autonomous regions in Papua, including the Acting Governor of South Papua Apolo Safaupo, Acting. Papua Regional Secretary Sumule Tumbo Mountains, Head of Agency (KABAN) Regional Financial Revenue and Asset Management Agency (BPPKAD) Southwest Papua Province Harjito, Head of Development Division (Kabid) of the Regional Revenue Agency (Bapenda) Papua Ardy Bengu.

Then, also present were the Head of the Regional Budget Preparation of the Central Papua BPPKAD Richard Kabuhung, the Head of the Planning and Evaluation of Revenue for South Papua BPPKAD Zaenab Fenetruma, the Head of Regional Tax Collection of BPPKAD South Papua and the Assistant for Economic Affairs and Development of the Secretariat for the Regional Secretariat of South Papua Province Sunarjo.

Fatoni explained that it is clear that the regulations governing regional taxes and levies on new autonomous regions need to be established as soon as possible as the basis for collecting regional taxes and levies in the Provinces of Papua Mountains, South Papua, Central Papua and Southwest Papua.

PAD is income earned by the region which is collected based on regional regulations in accordance with statutory regulations. Based on Law No. 1 of 2022 concerning financial relations between the central government and regional governments (HKPD), in conjunction with Government Regulation Number 35 of 2023 concerning General Provisions for Regional Taxes and Regional Levies, the collection of regional taxes and regional fees is carried out by Regional Regulations (Perda).

Meanwhile, the new autonomous regions have not been able to form regional regulations because they do not yet have a DPRD. So this meeting is useful to find solutions to these problems. The new autonomous regions need to establish a legal basis as soon as possible as a basis for collecting regional taxes and fees to increase PAD.

From the results of the meeting, an agreement was found which was set forth in the minutes and signed by the meeting participants, among others, namely to collect Regional Taxes and Regional Levies in the 4 new autonomous regions based on Governor Regulations until the establishment of regional regulations.

This is of course in line with the mandate of Article 9 paragraph (5) of the Law on the formation of each new autonomous region. The Governor’s Regulation is signed by the Acting Governor and a Regional Regulation will then be formed when the DPRD has formed the results of the 2024 election.

Previously, Indonesian President Joko Widodo (Jokowi) stated that the formation of 4 New Autonomous Regions (DOB) in Papua was based on community requests. The formation of the new autonomous region is aimed at equitable development in Cenderawasih Earth. The government also wants to increase the reach of public services so that they can reach all areas in Papua. The development of new autonomous regions will certainly foster infrastructure development such as roads and bridges which are of course representative. Thus land transportation will be more accessible.

Previously, the Head of the MeePago Tribe Hans Mote stated that he fully agreed and would provide full support to the government for the division of a new autonomous region in the land of Papua. With the division of this new autonomous region, it is hoped that Papua will become more advanced and its development will be evenly distributed in every line so that its people can progress too.

Moeldoko as Chief of Staff of the Indonesian President stated that the implementation of the Papua New Guinea is part of the government’s efforts to prosper the people of Papua. According to him, those who oppose Ppua’s new autonomous region by means of violence are those who do not want this accelerated welfare program to succeed. Even though members of the general public and Nduga basically want a peaceful and prosperous life, they do not want to be involved in acts of armed crime which are often carried out by terrorist separatist groups (KST).

He claimed that the formation of a new autonomous region in Papua was what the people wanted. According to Moeldoko, dividing the Papua region into Central Papua, Highlands Papua and South Papua, will bring public services closer to the people.

PAD is useful for supporting development in Papua, with PAD, of course development in Papua will be more advanced. Therefore, the Papua New Guinea levy is absolutely necessary so that the 4 new provinces can compete with other provinces.

)* The author is a Papuan student living in Jakarta